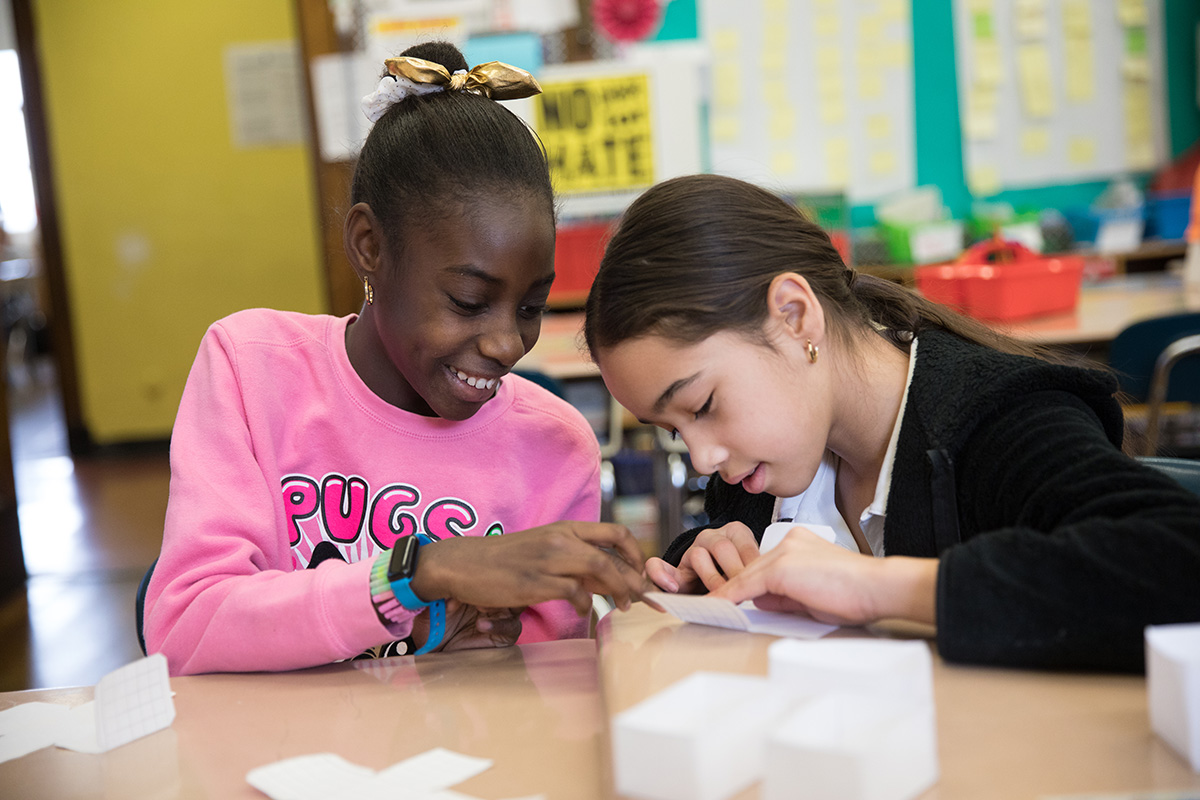

You can join ADL in fighting hate for good and have an immediate impact on the fight against antisemitism, extremism and all forms of hate.

Here are some ways that you can make a real impact right now.

Donor-Advised Funds

Charitable distribution from an IRA

Here’s how it works:

- You must be 70½ or older.

- Your gift must be transferred directly from your IRA account to ADL.

- An individual may take a one-time QCD up to $53,000 to fund a charitable gift annuity (CGA) or charitable remainder trust (CRT).

- Your gift is a transfer of funds from your IRA to ADL, so while it does not generate a charitable deduction, it does not create taxable income for you.*

- You may transfer up to a total of $105,000 per year (individual) or $210,000 (married couple).

- If you are required to take a Required Minimum Distribution from your IRA, your gift can count towards it, but your gift is not limited to your RMD. If you are using a checkbook issued by your IRA administrator to make your gift, please send your gift as early as possible to ensure that it qualifies for a distribution in the current year.

If you’re interested in this popular way to support ADL, download a sample letter for your IRA administrator.

*Due to recent changes in the laws governing retirement plans, please seek advice from your financial advisor regarding the tax implications of your gift, particularly if you plan to continue to contribute to your IRA after age 70½. Your gift may not qualify for these tax benefits.

Memorial or tribute gift

Gifts of appreciated securities

Gifts of tangible personal property

Gifts of cash

You can make your gift online with our secure online donation form or by sending a check or money order by mail to:

Anti-Defamation League Foundation (ADLF)

605 Third Avenue

New York, NY 10158

If you are sending a check or money order, please let us know if you would like your gift to be used for a specific purpose.

The Impact of Your Giving

$500/month

could sustain ADL's work to protect democracy and ensure a just and inclusive society for all.

$10,000

$50,000

given in your will, trust or by beneficiary designation could secure your legacy of justice and fair treatment for all.

Complimentary planning resources

are just a click away!